PBCO Financial Corporation Reports Q2 2023 Earnings

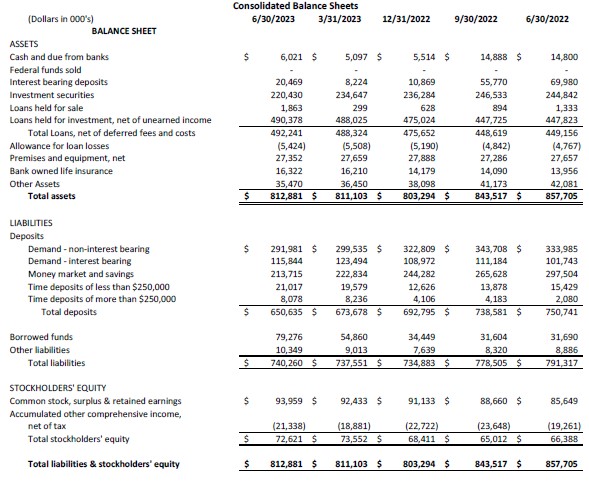

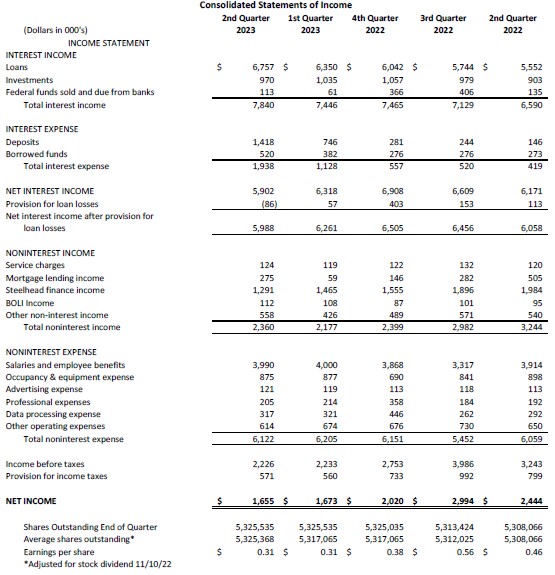

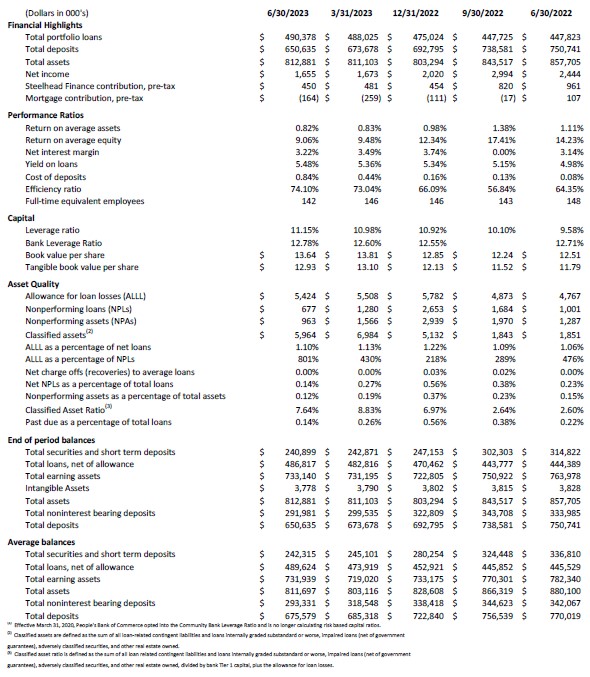

Medford, Oregon – July 19, 2023-PBCO Financial Corporation (OTCPK: “PBCO”), the holding company (Company) of People’s Bank of Commerce (Bank), today reported earnings of $1.65 million and earnings per diluted share of $0.31 for the quarter ended June 30, 2023, similar to $1.67 million and $0.31 per diluted share for the quarter ended March 31, 2023.

Highlights

- Portfolio loans increased 3.2% year to date as our Eugene operation gains traction

- Credit quality continues to improve with non-performing assets totaling only 0.12% of total assets

- Total non-interest expense declined slightly during the quarter from cost containment efforts

- Mortgage lending income showing improvement, reflecting the 1st quarter strategic investment in mortgage lending personnel

- Net interest margin declined to 3.22% during the quarter from 3.49% the prior quarter, reflecting the continued challenge of the rising rate environment

- Julia Beattie, appointed President and CEO after Ken Trautman’s retirement on June 30, 2023

“During 2nd quarter, the Bank continued to focus on quality loan growth supported by improved yields in the rising rate environment,” commented Julia Beattie, President and Chief Executive Officer. Loans increased $2.4 million in the quarter, or 0.50%, compared to the first quarter of 2023. “Although at a more moderate pace, the Bank’s loan portfolio continued to grow during the quarter, with demand for loans staying strong in spite of significantly higher borrowing costs than the same period last year,” commented Julia Beattie.

Non-performing assets improved in the second quarter to 0.12%, as a percentage of total assets, versus 0.19% in the first quarter 2023. “Although credit quality has been strong from a historical perspective, non-performing loans decreased from the prior quarter with the successful resolution of a non-accrual loan,” noted Bill Whalen, Chief Credit Officer. During the second quarter, the Allowance for Loan and Lease Losses (ALLL) decreased by $84 thousand utilizing the recently implemented Current Expected Credit Loss model that went into effect in January 2023.

Deposits decreased $23.0 million during the quarter, a 3.4% decline from the first quarter of 2023. “Contraction in deposits was due to continued rate competition, both from conventional banks as well as non-banking institutions, and the effects of quantitative tightening,” commented Beattie. “We continue to focus on retention and growth of strong core deposits driven by our philosophy of relationship banking,” continued Beattie. The Bank continued to experience increased funding costs as a result of rising deposit rate pressure and borrowing costs. Furthermore, the Bank strategically bolstered liquidity by participating in the Federal Reserve Bank Term Funding Program (BTFP).

The investment portfolio decreased 6.1% to $220.4 million in second quarter of 2023 from $234.6 million at the end of the first quarter 2023. This decrease is the result of maturing investments being reinvested in loan growth and liquidity. The average life of the portfolio was 4.5 years at the end of the second quarter. Securities income was $0.97 million during the quarter, a yield of 1.76%, versus $1.04 million, and the same yield of 1.76% for the first quarter of 2023. As of June 30, 2023, the net after tax unrealized loss on the investment portfolio was $21.3 million versus $18.9 million as of March 31, 2023, due to increased market rates. Highly rated government agency and government sponsored agency investments comprise 94.5% of the investment portfolio with the balance of approximately 4.5% held in municipal investments and 0.8% held in corporate sub-debt issued by community banks. As of second quarter 2023, liquid assets to total assets were 17.0%, including the market value of the investment portfolio less pledged investments.

Second quarter 2023 non-interest income totaled $2.4 million, an increase of $183 thousand from the first quarter of 2023. The improvement was driven in large part by mortgage lending income which increased $216 thousand, from the first quarter reported income of $59 thousand. “First quarter results were reflective of the very challenging mortgage environment responding to escalation in interest rates. While many mortgage lenders chose to retract their market presence, People’s Bank opted to make an investment in mortgage lending for the future,” commented Echo Hutto, the mortgage division manager.

Non-interest expenses totaled $6.1 million in the first quarter, down $83 thousand from the previous quarter, reflecting the Bank’s continued commitment to cost containment efforts. The reduction in expenses was attained even with the increase in payroll and related expenses from the bank’s recent expansion and strategic addition of additional mortgage related staff.

As of June 30, 2023, the Tier 1 Capital Ratio for PBCO Financial Corporation was 11.15% with total shareholder equity of $72.6 million. During the quarter, the Company continued to augment capital through earnings. The Tier 1 Capital Ratio for the Bank was 12.78% at quarter-end, up from 12.60% as of March 31, 2023. Tangible Capital was $68.8 million, or 8.47% as of June 30, 2023, versus Q1 2023 at $69.8 million or 8.60%. “The Bank’s strong capital position allows for quality growth and resilience during these uncertain economic times,” commented Ms. Beattie.

Ken Trautman and his partner, Mike Sickels, founded People’s Bank of Commerce 25 years ago. Mr. Trautman served as CEO from 2008 to his recent retirement on June 30, 2023. Julia Beattie, who was named President in June 2020, has been appointed CEO. “Having had the opportunity to work very closely with Ken over the past 3 years has provided me with a strong foundation to now assume the incremental responsibilities of CEO. We will remain focused on our Bank’s mission of helping the communities we serve to thrive, not only with our product offering, but also with a focus on relationship banking and community engagement,” commented Ms. Beattie.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Ashland, Central Point, Eugene, Grants Pass, Jacksonville, Klamath Falls, Lebanon, Medford, and Salem.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.